estate tax law proposals 2021

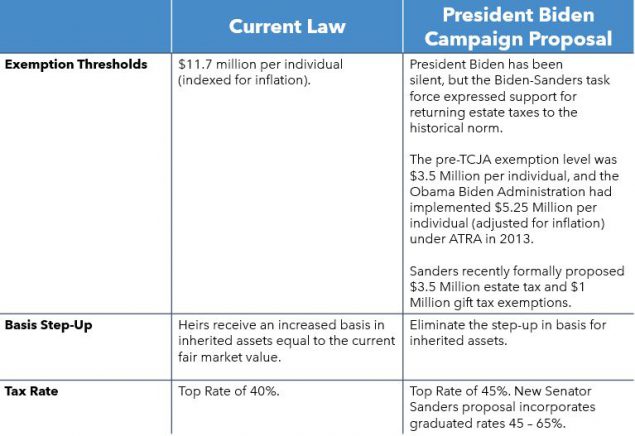

It is divided into four parts by subject matter as follows. It includes a reduction of the federal estate tax exemption from 117 million to 35.

Estate Planning Tips In Light Of Proposed Tax Bill Episode 311 Ira Financial Group

The measure proposes a 4 tax on real estate transactions residential and commercial of more than 5 million and a 55 tax on transactions greater than 10 million.

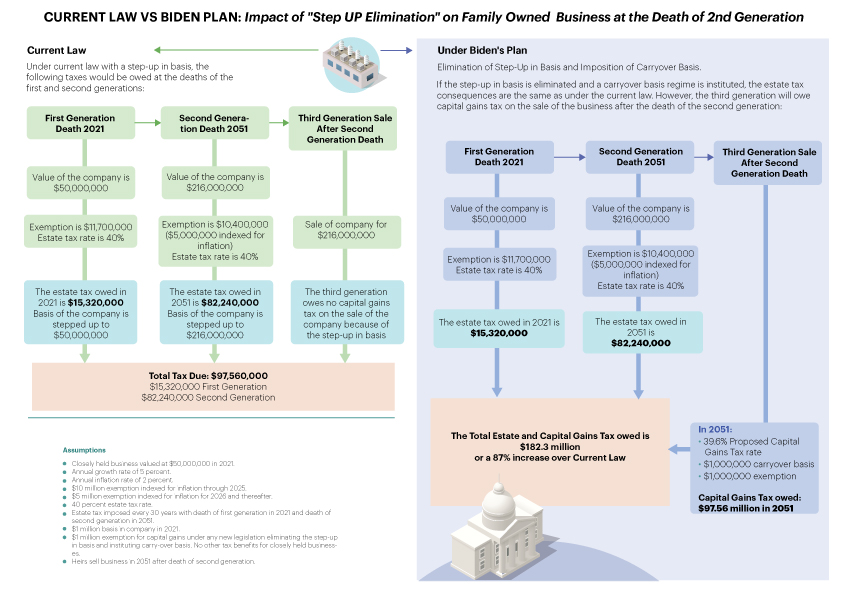

. The Estate Tax is a tax on your right to transfer property at your death. However the federal gift tax does still apply to residents of California. Targeted at multimillionaires and billionaires this proposal imposes a new death tax on many families with long term investments.

Currently the exemption is 11700000 for the 2021 tax year and any reversal to the 5000000 level will likely also be indexed for inflation. The current Residential Energy Efficient Property Credit was set to expire in 2024. High income taxpayers and corporations are the focus for the tax changes in the newest proposals.

Moore Attorney in the Estate Planning Probate Practice Group This last week. September 2 2021 This year has brought many proposals to Congress that would dramatically change the tax implications for many farm businesses. It consists of an accounting of everything you own or have certain interests in at the date of death Refer to.

An investor who bought Best Buy BBY in. Key Estate Planning Proposals September 21 2021 By Jeffrey G. Proposed Changes On September 27 2021 the.

The federal estate tax exemption is currently 117 million and the New York estate tax exemption is currently approximately 59 million adjusted for inflation. For the last 20 years the. However the Inflation Reduction Act extends it through 2034 rebrands it as the Residential.

A surcharge of 5 has been proposed for adjusted gross income AGI in. The 2022 Real Estate Law is comprised of statutes and regulations with which real estate practitioners should be familiar. The Tax Cuts and Jobs Act TCJA has also led to several changes to federal income tax depreciation rules.

This means that someone could leave an inheritance of 117 million and not be subject to federal estate or gift tax. 2021 Estate Tax Exemption. No California estate tax means you get to keep more of your inheritance.

The irs published a second set of proposed regulations the 2021. Under the proposed legislation the federal estate tax exemption which is the amount of ones estate that can pass free from tax at death would be sharply reduced. Indeed on March 25 2021 Senator Bernie Sanders released his own proposed tax bill.

Decrease of Estate and Gift Tax Exemption The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for. Bidens proposal is to increase estate taxes to a top rate of 45. California does not levy a gift tax.

On September 13 2021 the House Ways and Means committee released its proposals to raise revenue including increases to individual trust and corporate income taxes.

New Tax Proposals Mean Some Should Review Their Estate Plans Law Money Matters

Estate Tax Gift Tax Learn More About Estate And Gift Taxes

:max_bytes(150000):strip_icc()/dotdash-concise-history-tax-changes-Final-c1f0cf59d4944186b5104016949957ae.jpg)

A Concise History Of Changes In U S Tax Law

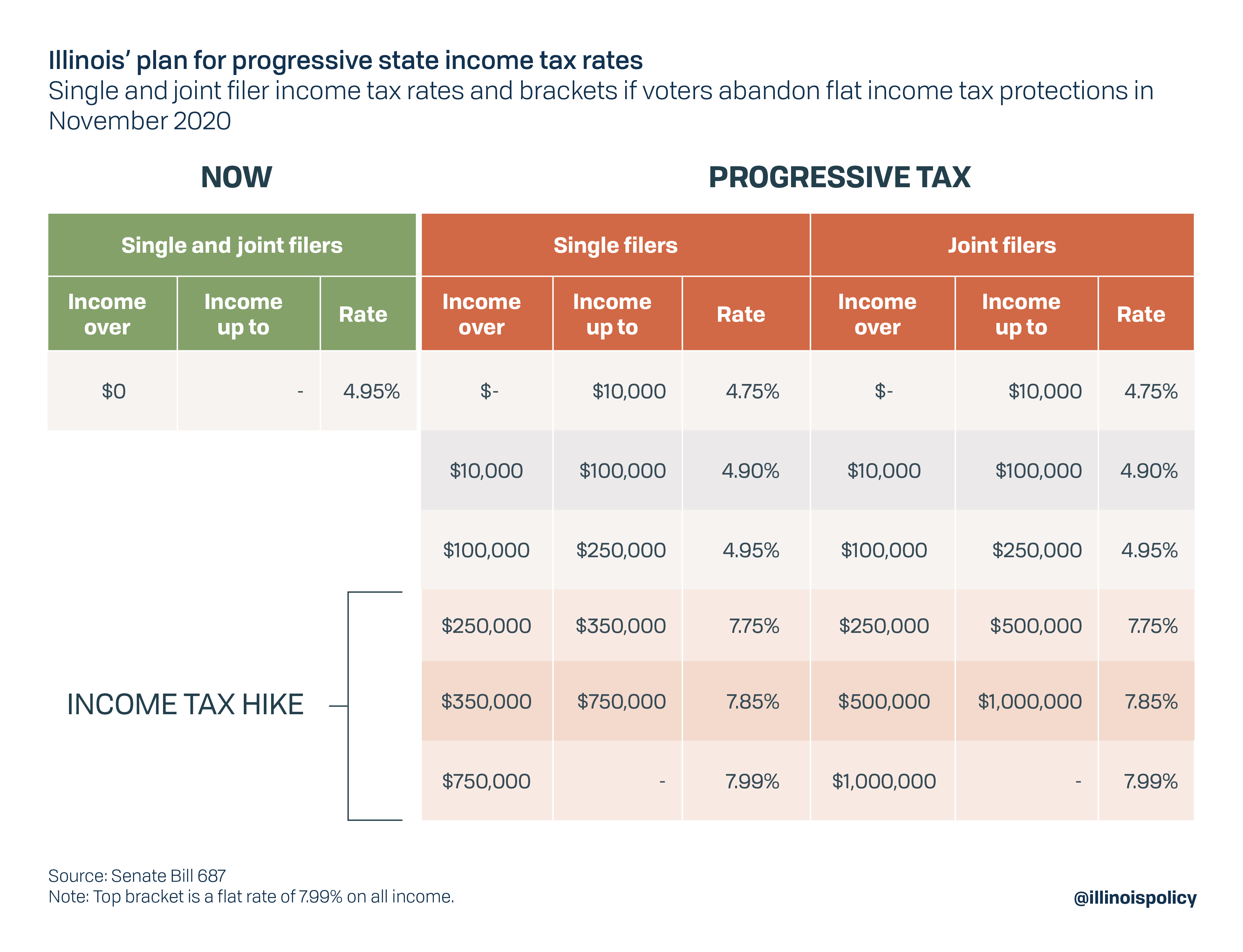

What Illinoisans Need To Know About The Progressive Income Tax

Proposed Legislation To Change Estate And Gift Tax Planning Stoel Rives Llp Jdsupra

Build Back Better Act And Estate Planning

How Could We Reform The Estate Tax Tax Policy Center

Ten Facts You Should Know About The Federal Estate Tax Center On Budget And Policy Priorities

Estate Tax Proposal 2021 Regina Kiperman Rk Law Pc

Scanning The Horizon In A Sea Of Noise Rockefeller Capital Management

Property Tax Increase Proposal Cartersville Georgia

Current Status Of Federal Estate And Gift Tax Proposals Ruder Ware Jdsupra

Your Fair Share Changes To Income Gains And Estate Taxes Open Window

The New Estate Tax Bill Proposed By Senator Bernie Sanders Jones Gregg Creehan Gerace

How Much Tax Will You Pay With Biden S Tax Plan Family Enterprise Usa

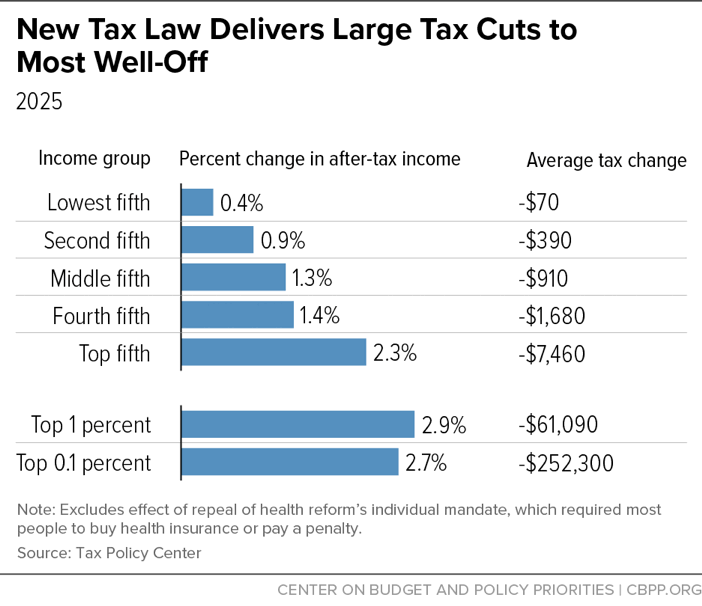

Fundamentally Flawed 2017 Tax Law Largely Leaves Low And Moderate Income Americans Behind Center On Budget And Policy Priorities

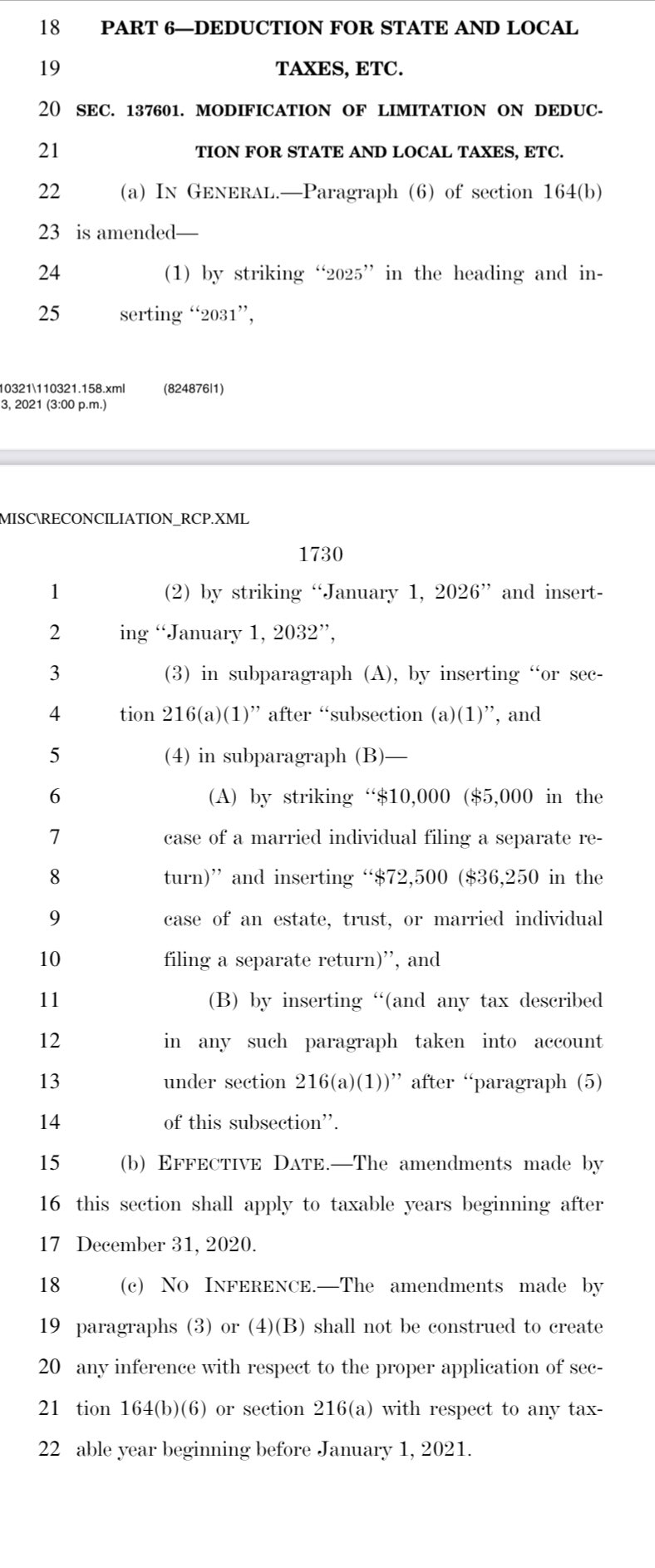

What Proposed Salt Changes Could Mean For Your Next Tax Bill Vox

How Many People Pay The Estate Tax Tax Policy Center

Proposed Changes To Estate Taxes Threaten Farmers And Ranchers Morning Ag Clips